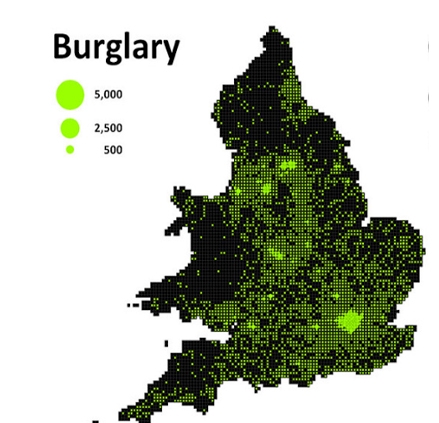

UK Burglary and Break-in trends from 2020 to 2025

Here’s a clear, data-driven picture of UK burglary and break-in trends from 2020 to 2025, broken out by the main UK regions and drawing on the latest official sources. Where possible I distinguish between “home” (residential) and “business” (non-residential) contexts. A quick note on methods: England & Wales use the same statistical system (largely Police Recorded Crime and the CSEW), Scotland publishes separate Recorded Crime statistics, and Northern Ireland publishes PSNI bulletins. “Burglary” is the closest like-for-like measure across the UK; “housebreaking” is Scotland’s equivalent.

UK at a glance (2020–2025)

- Pandemic dip, then partial recovery, then a fresh fall in 2024/25. Across the UK, the first pandemic year (2020/21) saw a sharp fall in burglary as restrictions kept people at home. Volumes rose again through 2021/22 and 2022/23 as activity normalised, then fell back in the year ending March 2025 in England & Wales and to decade-low quarterly levels in Northern Ireland. Office for National StatisticsPSNI

- Homes vs businesses. England & Wales police recorded 245,284 burglaries in the year ending March 2025, down 8% year-on-year (burglary here includes both residential and non-residential). Business-specific experience is best measured via the Commercial Victimisation Survey (CVS): in 2023, 8% of business premises in England & Wales experienced burglary (including attempts), with much higher overall crime exposure in wholesale & retail (41% experiencing any CVS-measured crime). Office for National StatisticsGOV.UK

England & Wales

Headline trend (police-recorded)

- 2020/21: Marked pandemic-related drop from pre-COVID levels.

- 2021/22–2022/23: Rebound as mobility returned.

- 2023/24 → 2024/25: Burglary down 8% to 245,284 offences in the year ending March 2025. Police data indicate burglary (across residential and non-residential) moved counter to other theft categories like shoplifting, which rose strongly in the same period. Office for National Statistics

This path matches what you’d expect: fewer empty homes/businesses in lockdowns suppressed opportunity; the resumption of commuting and nightlife brought volumes up; and 2024/25 shows renewed declines in burglary even as some theft types (e.g., shoplifting) climbed to series highs.

Homes (residential burglary)

- The Crime Survey (CSEW) shows long-term reductions in household theft and no statistically significant change in 2024/25 for domestic burglary, aligning with the recorded-crime fall in the burglary category overall. Office for National Statistics

Businesses (non-residential burglary)

- The CVS 2023 remains the best lens for business premises: 8% of all premises experienced a burglary (including attempts) in the prior 12 months. Exposure varies by sector and size; wholesale & retail premises are far more exposed, with 41% experiencing any CVS-measured crime (not just burglary). Larger premises and those open to the public also see higher victimisation. GOV.UK

- Police-recorded robbery of business property (a different offence from burglary but relevant to business security) rose 50% to 15,520 in YE March 2025, underlining pressure on certain commercial locations even as burglary fell. Office for National Statistics

What the numbers mean operationally (2020–2025):

- If you compare 2020/21 to 2024/25, homes benefitted first from the “everyone at home” effect; later, improved physical security and neighbourhood vigilance seem to have kept domestic burglary contained even as life normalised.

- For businesses—especially retail—exposure stayed elevated in 2022–2025 due to footfall returning, staffing pressures, and the concentration of goods. The CVS shows burglary is less common than customer theft, but it remains a persistent risk.

Scotland

Headline trend (recorded crime; “housebreaking”)

- Scotland measures “housebreaking” rather than the England & Wales “burglary” classification, but it captures the same core behaviour (breaking into a home or premises to steal).

- The Recorded crime in Scotland publication for 2024/25 confirms continued historically low levels of several property crime categories, with Scotland’s overall recorded crime remaining near long-term lows. (Housebreaking is part of “Crimes of dishonesty”.) Scottish Government

2020–2025 pattern:

- 2020/21: Pandemic-era lows (mirroring the rest of the UK).

- 2021/22–2022/23: Normalisation brought volumes up from the trough but not to pre-2019 peaks.

- 2023/24–2024/25: Housebreaking remained comparatively low by historical standards, consistent with the longer-term downtrend in Scotland’s property crime.

Why no single rate table here? Scotland’s statistical series is separate from ONS and uses a slightly different offence framework. The national publications remain the authoritative source for annual counts and trends, but direct, like-for-like splits (e.g., residential vs non-residential) are not always presented in the same way as England & Wales.

Northern Ireland

Headline trend (PSNI recorded crime)

- PSNI shows burglary at decade-low quarterly levels in early 2025: the Jan–Mar 2025 quarter recorded the lowest burglary levels in the last ten years of the series. PSNI

- Looking at the freshest monthly point, March 2025 saw 241 burglaries in Northern Ireland (monthly figure; the bulletin also highlights the ten-year low in the quarter). PSNI

2020–2025 pattern:

- 2020/21: Pandemic-era suppression.

- 2021/22–2022/23: Recovery from the trough, but not to earlier highs.

- 2023/24–2024/25: Downward drift resuming, culminating in the decade-low quarter at the start of 2025.

Homes vs businesses:

- PSNI charts separate “theft offences – burglary” within the broader theft category; they don’t publish a simple headline split between residential/non-residential in the bulletin narratives, but the overall signal shows burglary trending down to series lows into 2025. PSNI

Wales (context within England & Wales)

Wales’ forces are embedded in the England & Wales series that ONS publishes. So, the Welsh trend line for burglary mirrors the national pattern:

- 2020/21: Pandemic trough.

- 2021/22–2022/23: Partial recovery.

- 2024/25: Contribution to the England & Wales-wide 8% fall in burglary, with local variation by force area. More granular figures (by police force in Wales) live in the ONS open data tables, but the national bulletin is the most reliable “single-page” reference for 2024/25 totals and trends. Office for National Statistics

Business break-ins in focus (cross-UK insights)

- Prevalence, not just counts, matters for businesses. The CVS 2023 (England & Wales) estimates 8% of premises experienced burglary (including attempts) in the previous 12 months. Wholesale & retail premises report the most crime contact overall (41% experienced any CVS crime), with premises open to the public and larger sites having higher exposure. While the CVS is not run UK-wide, its findings closely reflect what many Scottish and Northern Irish retail bodies report qualitatively: retail and hospitality premises remain disproportionately at risk. GOV.UK

- Robbery of business property (again, different from burglary) rose 50% in YE March 2025 in England & Wales, signalling that some business-facing threats have intensified even as burglary fell. Office for National Statistics

2020 → 2025 regional timeline (condensed)

England & Wales

- 2020/21: Pandemic lows.

- 2021/22–2022/23: Rebound from trough as mobility returns.

- 2023/24: Plateau to slight increase from the trough.

- 2024/25: Burglary down 8% to 245,284; shoplifting and some business-facing risks (e.g., robbery of business property) up. Office for National Statistics

Scotland

- 2020/21: Housebreaking down sharply.

- 2021/22–2022/23: Partial recovery from the low base.

- 2023/24–2024/25: Housebreaking remains historically low within the broader “Crimes of dishonesty” trend. Scottish Government

Northern Ireland

- 2020/21: Pandemic lows.

- 2021/22–2022/23: Partial recovery.

- 2023/24–2024/25: Jan–Mar 2025 burglary at the lowest quarterly level in a decade; March 2025 = 241 burglaries (monthly). PSNI

Wales

- Embedded in E&W; mirrors the 8% fall in 2024/25 at the national level, with local variation by force area visible in the ONS open data tables. Office for National Statistics

Practical takeaways for 2025

- Homes: Despite the recent fall, the opportunity structure is returning to “normal” post-pandemic, so traditional measures still pay off: layered physical security (PAS 24 doors/windows, locks aligned with BS standards), monitored alarms, and neighbourhood watch coordination. The CSEW’s flat trend underscores that prevention remains effective—keep doing the basics well. Office for National Statistics

- Businesses: Treat burglary as a stable but persistent risk alongside faster-rising problems like shoplifting and business-property robbery. The CVS makes it clear that public-facing premises and larger sites are more exposed—prioritise secure shutters/grilles, internal compartmentation, staff training (open/close routines), CCTV monitoring, and rapid reporting pathways. GOV.UKOffice for National Statistics

Sources (key, most recent)

- England & Wales: Crime in England and Wales: year ending March 2025 (ONS) – Burglary 245,284, down 8% y/y; context on theft and robbery of business property. Office for National Statistics

- Businesses (E&W): Crime against businesses: findings from the 2023 Commercial Victimisation Survey – 8% of premises experienced burglary, 41% of wholesale & retail premises experienced any CVS crime. GOV.UK

- Northern Ireland: Police Recorded Crime in Northern Ireland – Update to 31 March 2025 (PSNI bulletin) – Jan–Mar 2025 burglary at decade-low quarterly levels; March 2025 = 241 burglaries. PSNI

- Scotland: Recorded crime in Scotland (Scottish Government) – annual bulletin for 2024/25 confirms historically low levels across several property-crime categories; housebreaking is the nearest category to burglary. Scottish Government

A note on getting the exact regional splits you may want

If you need tables by English region or by each police force area (including the four Welsh forces) for 2020–2025, those are available in the ONS open data tables and can be extracted into a tidy spreadsheet by year and by residential/non-residential burglary. Likewise, Scotland and Northern Ireland publish downloadable tables alongside their bulletins. I can pull those into a single harmonised sheet if you’d like.